Tax Brackets 2025 Married

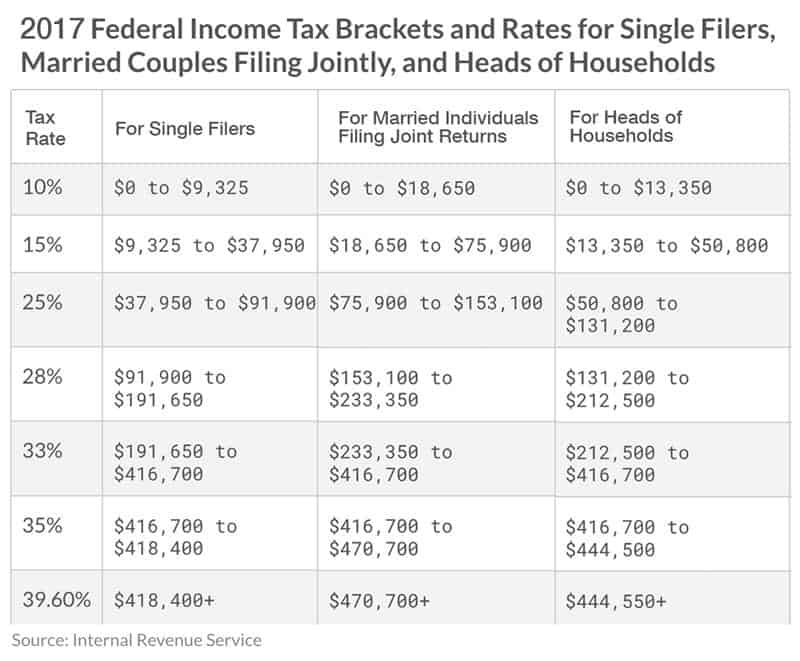

Tax Brackets 2025 Married. For married couples filing jointly, the 2025 standard deduction rose from $29,200 to $30,000 (an increase of $800) and for people who file as head of household the 2025. The tax brackets are divided into income ranges, and each range is taxed at a different percentage.

This article will look into the intricacies of tax brackets for married couples. This creates tax parity, eliminating.

Tax Brackets 2025 Married Images References :

Source: jamesball.pages.dev

Source: jamesball.pages.dev

Irmaa Brackets 2025 Married Filing Separately James Ball, The federal income tax has seven tax rates in 2025:

Source: katherinedyer.pages.dev

Source: katherinedyer.pages.dev

2025 Tax Brackets Married Filing Separately Married Filing Katherine Dyer, This creates tax parity, eliminating.

Source: soniapaige.pages.dev

Source: soniapaige.pages.dev

Standard Tax Deduction 2025 Married Jointly Under 80c Sonia Paige, Indexed tax tables and qcd limits for 2025 the federal tables below include the values applicable when determining federal taxes for 2025.

Source: virginiabell.pages.dev

Source: virginiabell.pages.dev

2025 Tax Brackets Married Filing Separately Married Virginia Bell, The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

Source: june2025calendarprintablefree.pages.dev

Source: june2025calendarprintablefree.pages.dev

2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, * 37% for incomes over $626,350 ($751,600 for married couples filing jointly);

Source: jennifergrants.pages.dev

Source: jennifergrants.pages.dev

2025 Tax Brackets Married Filing Separately Single Jennifer Grants, Here are the new tax brackets for 2025:

Source: anthonyross.pages.dev

Source: anthonyross.pages.dev

2025 Tax Brackets Married Jointly Married Anthony Ross, For the 10%, 12%, 22%, 24%, and 32% tax brackets, the income thresholds for married couples filing jointly are double those for singles.

Source: keithgraham.pages.dev

Source: keithgraham.pages.dev

Tax Bracket 2025 Married Filing Separately Single Keith Graham, Married couples filing separately and head of household filers;

Source: nellmargery.pages.dev

Source: nellmargery.pages.dev

Tax Brackets 2025 Married Jointly Theo Adaline, They are published in revenue.

Source: debeebcharity.pages.dev

Source: debeebcharity.pages.dev

2025 Married Filing Jointly Standard Deduction Nyssa Arabelle, * 37% for incomes over $626,350 ($751,600 for married couples filing jointly);